The UK’s economic output declined for two consecutive quarters in the second half of 2023, pushing the country into recession.

Gross domestic product (GDP) fell by a steeper-than-expected 0.3% in October-December, following a 0.1% contraction from July to September, the Office for National Statistics (ONS) said.

Economists had anticipated a decline of 0.1% in the final three months of the year.

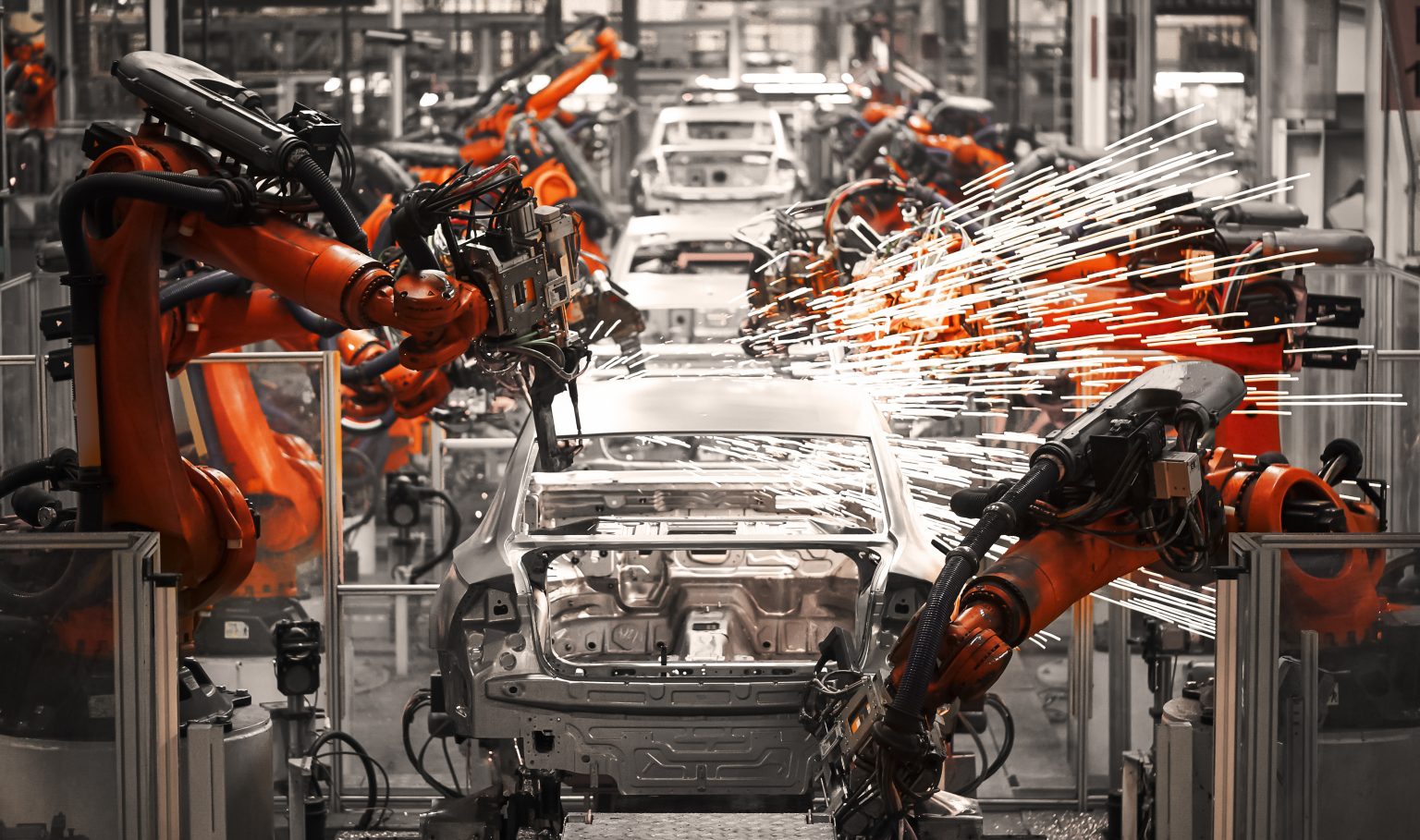

ONS director of economic statistics Liz McKeown said that manufacturing, construction and wholesale were the biggest drags on growth in the quarter, partially offset by increases in hotels and rentals of vehicles and machinery. Across 2023 as a whole, the economy was “broadly flat”.

A recent analysis by Goldman Sachs found that the decision to leave the European Union has left the UK economy around 5% worse off than it would otherwise have been.

The GDP figures come less than three weeks before Chancellor Jeremy Hunt delivers his next Budget.

Responding to the data, Hunt said: “High inflation is the single biggest barrier to growth which is why halving it has been our top priority. While interest rates are high — so the Bank of England can bring inflation down — low growth is not a surprise.

“But there are signs the British economy is turning a corner; forecasters agree that growth will strengthen over the next few years, wages are rising faster than prices, mortgage rates are down and unemployment remains low. Although times are still tough for many families, we must stick to the plan — cutting taxes on work and business to build a stronger economy.”