The recent collapse of three major employee-owned firms raises questions about the model’s sustainability.

- Buckingham Group, Readie Construction, and Michael J Lonsdale all entered administration recently, sparking debate over inherent model risks.

- Key challenges cited include inflation, subcontractor failures, and geopolitical factors, intensifying financial strain.

- Collectively, the companies paid nearly £34m to trusts, surpassing profit margins and contributing to fiscal challenges.

- Industry experts remain divided on whether employee ownership can remain a viable solution in the volatile construction sector.

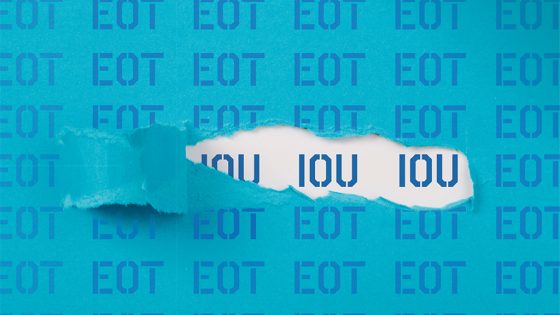

In the last year, the construction industry has witnessed the collapse of three prominent employee-owned companies: Buckingham Group, Readie Construction, and Michael J Lonsdale. This has spurred discussions about the potential weaknesses of the employee ownership trust (EOT) model. As noted by directors, these firms faced mounting pressures from external factors like inflation, the lingering effects of the COVID-19 pandemic, disruptions caused by the war in Ukraine, and the failure of subcontractors. These elements have strained many in the sector; however, an underlying question remains whether the EOT model exacerbated these challenges by placing additional pressure on company cash flows.

A detailed examination of the companies’ financial disclosures reveals that, since 2020, the three contractors collectively contributed £33.95m to EOTs, despite their pre-tax losses totalling £4.7m. This imbalance raises concerns about the financial sustainability of opting for employee ownership in challenging economic times. EOTs have been increasingly popular since 2014, following changes to tax rules introduced by the coalition government to incentivise this ownership model. These changes allowed shareholders to avoid capital gains tax from share sales, while enabling tax-free bonuses for employees. Yet, there are critiques that these benefits may not have sufficiently offset the operational and financial hurdles posed by this ownership framework.

Michael J Lonsdale, for instance, aimed to establish a long-lasting legacy and promote workforce ownership by transitioning to employee ownership in 2020. Despite initial enthusiasm, the company faced administration by October 2023, owing to multiple external economic challenges. The ambitious plan of a four-year transition to new leadership was largely thwarted, suggesting that while the ownership model held potential benefits, it lacked resilience against severe economic downturns.

Buckingham Group, with a notable £665m turnover, also transitioned to an EOT in 2021. Nevertheless, it reported a substantial pre-tax loss of £10.7m, partly due to losses on specific projects and the larger fiscal burden introduced by its EOT payments. The directors remained optimistic about achieving long-term success under this model, citing benefits such as profit-sharing and tax incentives. However, the anticipated profits failed to materialise, casting doubt on the effectiveness of an EOT in turbulent economic climates.

Similarly, Readie Construction’s shift to employee ownership in 2021 came with its own set of challenges. While initially posting a £1.9m profit in the following year, the company soon encountered losses, driven by inflationary pressures and a transformative credit insurance market. Its contributions to its EOT also exceeded its financial capacity, underscoring the critical need for conservative financial strategies to navigate such transitions.

The construction sector, known for its slim profit margins, remains sceptical about uniformly adopting the EOT model. Experts like Chris Davies of DRS Bond Management advocate for cautious financial management, emphasising that contractors must insulate themselves against market fluctuations by maintaining stable cash reserves. The notion that ‘cash is king’ remains prevalent, with a conservative approach often being the recommended strategy. Meanwhile, HMRC’s proposed reforms to EOT regulations aim to mitigate risks by limiting former owners’ influence over trusts. This evolves a cautious approach to managing these entities.

Despite the setbacks faced by these firms, EOTs are likely to continue playing a role within the construction industry. Analysts point out that mergers and acquisitions have become less attractive, private equity demands high returns, and management buyouts often burden businesses with debt. Thus, EOTs provide an alternative avenue for business continuity without the drawbacks. However, the model’s ultimate success hinges on the capability and strategic foresight of the management teams steering these companies.

The sustainability of employee ownership trusts in the construction industry remains contentious, requiring careful strategic oversight and financial prudence.