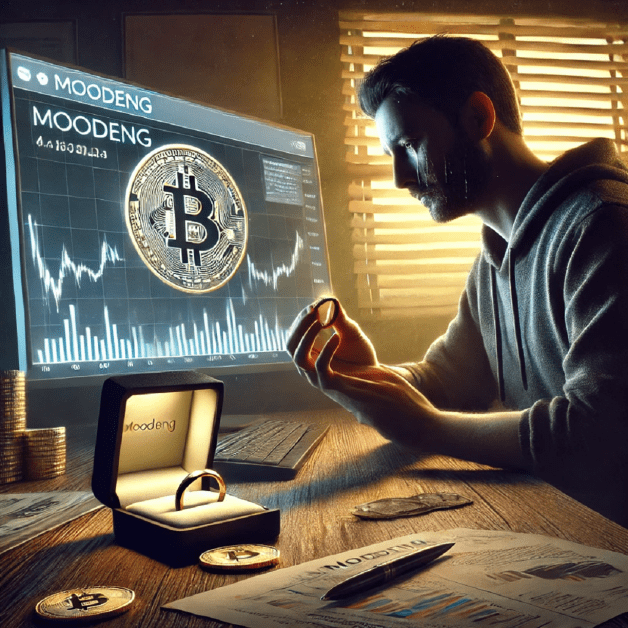

Navigating the crypto landscape can often feel akin to a rollercoaster ride. Recently, one trader made headlines by selling his wedding ring to buy Moodeng, only to watch its value plummet. It serves as a cautionary tale about the volatility of cryptocurrency investments.

The trader’s experience highlights the importance of strategic thinking and emotional restraint in the world of crypto. As prices fluctuate wildly, informed decisions are crucial to avoid unnecessary losses and regrets.

The Price of Emotional Decision-Making

When emotions dictate financial decisions, the results can be disastrous. In this case, the trader’s decision to trade a symbol of love for a volatile asset like Moodeng was driven by emotion rather than logic. This mistake underscores the need to separate emotions from investments to avoid similar pitfalls.

As the story unfolded on social media, it became evident that impulsive decisions rarely yield positive outcomes in the volatile crypto market. Keeping a level head and basing decisions on data, not impulses, can preserve both financial and personal assets.

Diversification: A Key Investment Strategy

A cardinal rule in investing is to diversify one’s portfolio. Instead of focusing solely on Moodeng, the trader could have balanced his investments across various asset classes, such as stocks or real estate. This would have mitigated the impact of Moodeng’s downturn, providing stability against market shifts.

Diversification reduces risk by spreading investments. Had the trader adopted this approach, the financial hit from Moodeng’s decline might have been less severe. Emotional investments should never override rational, diversified strategies.

[twitter-embed-display twitter_url=’https://twitter.com/basedbidets/status/1846991142753071410′]

Understanding Market Timing Challenges

The belief that Moodeng was a sound investment was a miscalculation. This highlights the unpredictable nature of cryptocurrency markets. Rather than gamble on upward trends, a stable, long-term plan often yields better outcomes.

As the trader learned, chasing quick profits without understanding the broader market trends can lead to significant losses. Market stability should be prioritised over speculative gains.

Lessons in Investment Caution

This narrative offers valuable lessons in exercising caution with investments. The trader’s experience with Moodeng illustrates the risks associated with overinvesting in single assets. Spreading resources across various investments helps manage potential losses, ensuring more secure financial growth.

Assessing risk and implementing cautious investment practices are paramount for anyone in the crypto space. Avoiding emotional decisions and embracing diversified strategies safeguard against costly missteps.

Financial and Personal Implications

Investing in volatile markets can have profound personal and financial repercussions. The trader’s story highlights the personal costs of risky financial decisions, such as sacrificing meaningful possessions.

Crypto investments might offer the allure of quick wealth, but the potential for rapid loss is equally significant. Balancing the desire for profit with the reality of investment risks can prevent potential personal and financial turmoil.

Final Thoughts on Strategic Investing

This account encapsulates the essential elements of strategic investing: diversification, emotional control, and market timing. For those dabbling in cryptocurrencies, these principles are especially relevant in mitigating risks and optimising returns.

Avoid the pitfalls experienced by the trader with Moodeng by adhering to these foundational strategies. Informed decision-making and patience drive successful investing.

Takeaway from a Trader’s Journey

The trader’s journey underscores the importance of informed, cautious investment approaches. Learning from such experiences can guide future investment decisions towards greater security and success.

In conclusion, while the allure of quick gains is tempting, strategic planning and emotional discipline are critical in navigating volatile markets. Diversification remains key in safeguarding investments, ensuring a balanced and secure financial future.