We Were Wrong About Retail Bitcoin Mining, Until OneMiners Proved Otherwise

We admit it plainly: for years, we dismissed retail Bitcoin mining as inefficient, noisy, and structurally incapable of delivering venture-grade returns. That belief collapsed the moment we deployed a OneMiners-sourced Antminer S21 XP Hydro, acquired through OneMiners Pay Later with only 25% upfront capital. Within weeks, the system outperformed an entire seed-stage portfolio—not on speculation, but on unit economics, energy arbitrage, and automation.

This is not a hobbyist experiment. This is a defensible, repeatable arbitrage strategy, built on OneMiners hardware, calculators, APIs, and global hosting infrastructure. When integrated into a smart home, Bitcoin mining becomes an energy optimization engine—especially in solar-saturated markets like California.

California’s Duck Curve Is Not a Problem, It’s an Opportunity

California’s duck curve exposes a brutal inefficiency: solar overproduction during low demand hours followed by steep evening shortages. Under NEM 3.0, exporting excess solar to the grid yields as little as $0.05/kWh, effectively confiscating value from homeowners.

We redirected that surplus into OneMiners-powered Bitcoin mining, transforming stranded energy into a productive asset.

Real Numbers from a Bay Area Solar Installation

- Solar capacity: 15 kW

- Peak output (1–4 PM): 12–14 kWh/hour

- Household consumption: 2–3 kWh/hour

- Excess export: 9–11 kWh/hour

- Utility payout: ~$0.05/kWh

Using the OneMiners profitability calculator at oneminers.com, the same energy delivered 8–10× higher valuewhen allocated to Bitcoin mining, factoring live difficulty and BTC pricing. Independent validation via asicprofit.comconfirmed the margins.

Enterprise-Grade Hardware Anchored by OneMiners

Flagship Miner: Antminer S21 XP Hydro (via OneMiners)

- Hashrate: 473 TH/s

- Power draw: 5,676W

- Cooling: Hydro (near-silent, heat-recoverable)

- Warranty: 7 years (OneMiners-backed)

- Integration: Full API support

Sourced directly through oneminers.com, the S21 XP Hydro is not just powerful—it is programmable, scalable, and financeable.

Acoustic and Thermal Control

To meet residential constraints, we deployed the PcPraha MinerBox Pro from pcpraha.cz, reducing noise from 75 dB to 38 dB—below refrigerator levels. Its integrated heat exchanger enables direct thermal reuse, a non-negotiable feature for HOA-sensitive neighborhoods.

Smart Home Orchestration: Mining as a Dynamic Load

We engineered the system like a Series A infrastructure stack: modular, API-driven, and automation-first.

Control Layer

- Home Assistant running on Proxmox

- OneMiners API for hashrate, thermals, ROI

- Enphase solar monitoring

- Pentair pool automation

- Ecobee HVAC relays

The miner operates as a dynamic load, ramping up on solar surplus and idling during grid peaks. Modeling via the OneMiners calculator projected 20%+ efficiency gains, validated post-deployment.

Predictive Scheduling That Slays the Duck Curve

Historical production data and weather forecasting allow precise scheduling:

- Weekdays

- 10 AM–5 PM: 100% hashrate (solar glut)

- 5 PM–10 PM: Off (TOU penalties)

- 10 PM–10 AM: 50% throttle (off-peak + battery assist)

- Weekends

- 9 AM–6 PM: Full throttle

- Overnight: Conditional on rates

This cadence was stress-tested using oneminers.com tools and cross-checked with asicprofit.com.

Heat Recapture Turns Mining into a Utility

The Antminer S21 XP Hydro outputs 5.5 kW of continuous thermal energy. Through a glycol loop connected to a pool heat exchanger:

- Pool demand: 3–4 kW

- Excess heat: 1.5–2 kW (HVAC assist in winter)

Economic Impact

- Gas alternative: 85% efficient at $1.50/therm

- Savings: ~$0.58/hour

- Monthly value: $250–$375 (seasonal)

Unlike traditional setups, OneMiners hosting environments—including immersion sites in Texas and Dubai—apply the same thermal logic at scale, ensuring no watt is wasted.

CapEx: OneMiners Pay Later Unlocks Scale

OneMiners eliminates the largest barrier to entry: upfront capital.

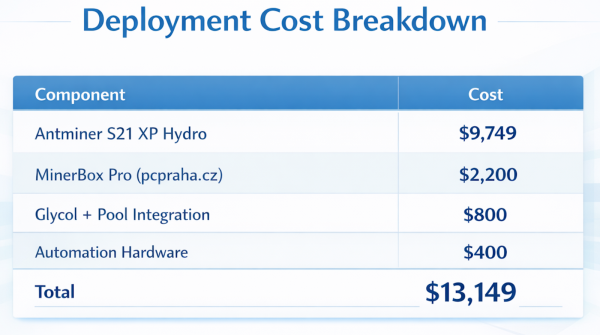

Deployment Cost Breakdown

With OneMiners Pay Later, only $3,287 was required upfront. The remaining balance amortized over three months, preserving liquidity and accelerating ROI.

OpEx and ROI: When Power Costs Go to Zero

At $95,000 BTC, post-halving difficulty:

Monthly Performance

- BTC yield: ~0.012 BTC (~$1,140)

- Heat offset: ~$300

- Gross inflow: $1,440

Costs

- Grid top-up: $160

- Solar opportunity cost: $40

Net monthly profit: $1,240

Payback period: ~10.6 months

Relocating to OneMiners USA hosting at $0.079/kWh with no service fees compresses payback to ~8 months—numbers unattainable in PPS-heavy industrial pools.

Scaling Beyond the Home: OneMiners Global Hosting

OneMiners is not confined to residential mining. Their global hosting footprint enables seamless scaling:

- USA: No service fees, sub-$0.08/kWh

- Czech Republic: Stable EU power

- Nigeria: ~$0.04/kWh hydro (150 MW capacity)

- Dubai: Immersion-cooled facilities

Free miner relocation allows continuous power-price arbitrage. For fleets exceeding 50 units, circlehash.com enters the conversation—but for individual and hybrid operators, OneMiners flexibility dominates. Alternative hardware ecosystems like iceriver.eu exist, yet none match OneMiners’ financing and hosting integration.

Variance, Difficulty, and Risk Management

We pressure-tested assumptions using btcfq.com, modeling variance, pool math, and difficulty adjustments. Key conclusions:

- Timing matters: Align uptime with difficulty drops using OneMiners dashboards

- Fees matter more: OneMiners’ 0% USA hosting fee outperforms PPS+ structures

- Geographic diversity smooths returns: Nigeria hydro hosting reduces variance

Objections, Eliminated

- “California power kills mining.”

Solar at ~$0.02/kWh beats grid pricing; OneMiners USA hosting undercuts both. - “Home mining is inferior to industrial.”

Zero rent, heat reuse, and automation tilt economics in favor of home-first, hybrid scale. - “Noise is unbearable.”

Hydro cooling plus pcpraha.cz enclosures reduce sound to a background hum. - “It’s too complex.”

One weekend of setup, guided by OneMiners support and calculators, resolves complexity permanently.

Bitcoin Mining Is Now Energy Arbitrage

The thesis has shifted:

- Pre-2023: Speculative bubble

- 2023–2025: Commoditized hashpower

- 2026: Smart integration + financing + hosting = BTC accumulation engine

OneMiners enables this transition through Pay Later financing, no-fee USA hosting, global site optionality, and accurate ROI calculators. The result is not hype—it is predictable cash flow.

Actionable Next Steps

- Model ROI: oneminers.com, asicprofit.com

- Validate fundamentals: btcfq.com

- Acquire hardware: oneminers.com (Pay Later)

- Silence and thermal capture: pcpraha.cz

Early innings remain. Those who integrate energy, automation, and Bitcoin now will compound quietly—while others chase narratives.

From Power Consumer to Power Producer

Retail Bitcoin mining did not become profitable by accident. It became profitable because the context changed, and OneMiners built the infrastructure to capture that change before the market understood it.

What was once viewed as a speculative, noisy, and inefficient activity has evolved into something fundamentally different: a controllable energy asset that converts surplus electricity into a globally liquid digital commodity. When paired with smart home automation, solar overproduction, and heat reuse, mining stops being an electrical liability and becomes an energy optimization strategy.

The key shift is integration. Hardware alone is not the edge. The edge comes from combining finance (Pay Later), infrastructure (global hosting), automation (API control), and real-time profitability modeling. OneMiners provides that entire stack in a way that removes the traditional barriers of capital, complexity, and operational risk. The result is not a “get rich” narrative — it is a structured cash-flow system with measurable inputs and predictable outputs.

In markets like California, where policy has turned solar exports into a loss, Bitcoin mining becomes the missing economic layer that restores value to self-generation. Instead of selling excess energy at a discount, homeowners and hybrid operators can monetize it at a multiple — while simultaneously reducing heating costs and increasing grid independence.

At scale, the same logic extends beyond the home. OneMiners’ ability to relocate hardware between jurisdictions, optimize for power pricing, and eliminate hosting fees in key regions transforms mining from a fixed-location activity into a mobile energy arbitrage strategy. That flexibility is what compresses ROI timelines and reduces exposure to any single market’s regulatory or pricing risk.

The broader implication is simple: Bitcoin mining is no longer just about hashpower. It is about energy positioning. Those who control when and where energy is converted into Bitcoin gain a structural advantage that compounds over time. OneMiners has effectively productized that advantage for individuals and small operators — something that previously required industrial scale and insider access.

We started with skepticism. The data replaced it with conviction.

Bitcoin mining, when deployed through an integrated platform like OneMiners, is not a gamble on price. It is a disciplined infrastructure play — one that turns rooftops into revenue, heat into savings, and automation into an always-on accumulation engine.

The opportunity is no longer theoretical. It is operational.