The RICS quarterly monitor reveals varied trends in Welsh commercial property.

- Industrial demand shows growth with a 25% positive net balance.

- Retail spaces experience a decline with a minus 23% net balance.

- Investment interest in industrial spaces rises despite overall negative trends.

- Expectations for the next quarter remain varied across sectors.

The Royal Institution of Chartered Surveyors (RICS) has published its latest findings, indicating that the commercial property market in Wales presents a mixed picture. According to the report, while there is an increase in demand for industrial spaces, evidenced by a positive net balance of 25%, the retail sector has not fared as well. A negative net balance of 23% was reported by Welsh surveyors regarding the demand for retail spaces.

Furthermore, overall investor demand continues to show a negative trend. Despite this, there is a slight improvement compared to previous figures, with a net balance of minus eight respondents indicating a fall in investor interest in Wales. Industrial spaces continue to outperform office and retail spaces in terms of investor enquiries. Specifically, a net balance of 12% noted increased enquiries for industrial properties, whereas office and retail spaces registered declines with net balances of minus 13% and minus 21%, respectively. It is notable, though, that these figures are less negative than those observed in the second quarter.

Regarding capital value expectations for the next three months, there is a general anticipation of a decrease, with a net balance of minus 9% expecting a fall. However, a contrast is seen in the industrial sector, where a positive net balance of 13% anticipates a rise in capital values. In contrast, retail and office spaces remain subdued with net balances of minus 33% and minus 8%, respectively. Looking ahead over the next year, there is cautious optimism with a net balance of 7% of surveyors expecting an increase in capital values.

Rental expectations for the coming quarter also present a varied outlook. A net balance of 14% of surveyors predict a decrease in rents overall, despite a projected increase in industrial space rents by 25%. Office and retail spaces are expected to see rental declines, with net balances of minus 21% and minus 46%, respectively. On a broader 12-month horizon, there is an expectation of rental increases at the all-sector level, with 9% of respondents indicating such an outlook.

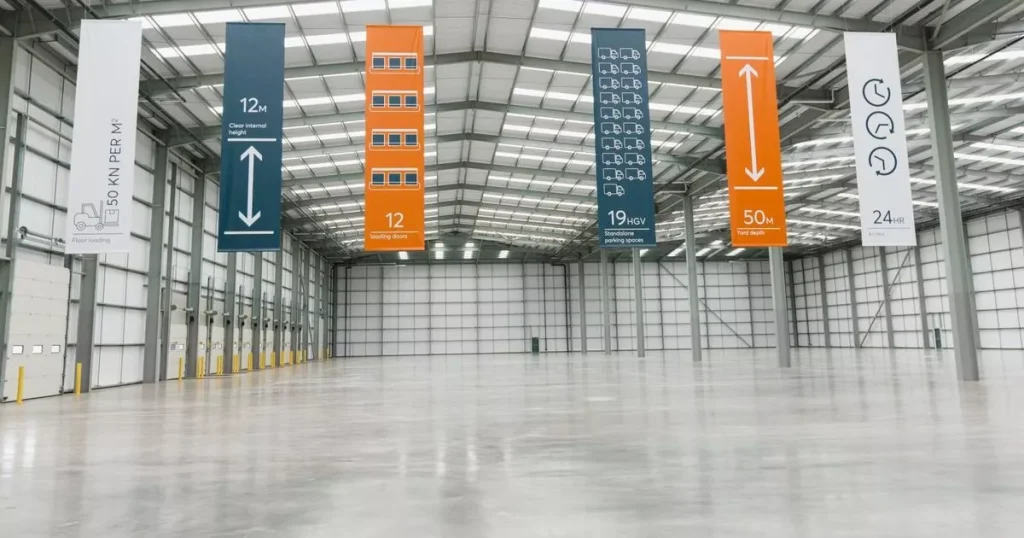

Chris Sutton, from Sutton Consulting in Cardiff, noted the extended summer slowdown in transactions and highlighted the busy period leading up to the Budget. He emphasised that the industrial sector remains robust, particularly along the M4 corridor, while the office market seeks high-quality buildings. For second-hand Grade B office space, challenges persist.

Tarrant Parsons, a senior economist at RICS, provides insight into the broader UK market, suggesting that while current performance might seem underwhelming, there are grounds for optimism. He cites an improving lending environment as a potential catalyst for increased investment activity in commercial real estate. Optimistic expectations for capital value and rental growth over the next twelve months align with a tentative market upturn.

The RICS data highlights a complex landscape for Welsh commercial property, with industrial spaces maintaining an advantage amidst varied sector performance.